Executive summary:

- Return to profitability indicates that the "Shift Plan" is working.

- Partnership with Qualcomm to launch multimode cells in 2014 will benefit Alcatel in the coming years.

- Continued divestment will improve Alcatel's overall financial outlook, helping it to sustain profitability in the long-run.

- Despite the heroics of 2013, Alcatel is cheaper than its peers and has more room to grow.

- A great buy at present valuations.

Everyone loves comebacks. Betting on the turnaround of a company can prove to be very lucrative for investors and over the last few years, tech investors have witnessed a number of impressive turnarounds. 2013 was a good year for many struggling companies like Nokia (NOK) and Hewlett-Packard (HPQ); however, French-American communications giant Alcatel-Lucent (ALU) was the center of attention. Shares of Alcatel-Lucent appreciated over 300% in 2013 owing to the long-awaited rebound in the telecommunication equipment industry. And I expect the company to continue its bull run in 2014 due several factors which I have discussed below.

"Shift Plan" Is Working

Alcatel-Lucent is headed in the right direction under the leadership of new CEO Michel Combes. Combes' bold Shift Plan,

which includes vigorous cost saving initiatives like diversification

and overhead reduction, seems to be working out perfectly. This is

evident by the fact that Alcatel-Lucent delivered its first quarterly

profit in two years earlier this month. For the reported quarter,

Alcatel's adjusted earnings came in at $0.08 per share, which was well

above the consensus estimate of negative $0.01. Gross margin for the

quarter was also up 400 basis points to 34.3%, while free cash flow

improved $164.5 million.However, on the revenue front, Alcatel fell short of the consensus estimate $5.7 billion by $300 million. The main question is, with top-line growth being non-existent; will Alcatel be able to continue its bullish run in 2014? I think it can and here's why.

Deal With Qualcomm Will Benefit Alcatel

Alcatel announced a partnership with Qualcomm (QCOM)

to develop multimode cells in July 2013. The multimode cells that

combine Alcatel's lightRadio radio access network (RAN) with Qualcomm's

small cell chips are expected to hit the market by mid-2014. The two

companies expect to launch small cells with improved wireless network

reception in environments such as urban areas, shopping malls and other

enterprise venues. Mike Schabel, VP of Alcatel-Lucent's small cell

department, declared that all of Alcatel's small cells will have

integrated Wi-Fi going forward.As of now, site acquisition, and delivery of backhaul are the primary factors restricting the wide-scale deployment of small cells. However, Alcatel aims to steer clear of these roadblocks by a site certification program that brings together a variety of partners.

As of January, Alcatel has 65 contracted, revenue-generating customers in 42 countries. The soaring sales of smart devices have led to an increase in demand for data usage and rollout of small cell base stations is expected to boost network speed, help operators speed installation of the vendors' metro cells, and reduce overheads for the company.

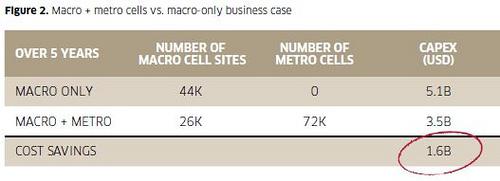

Source: LightReading.com

Schnabel said Alcatel-Lucent now has a database of 600,000 qualified sites across the United States and Western Europe that are available for small cell deployment and as per a report from the Small Cell Forum; this number could rise to nearly 11.5 million by 2018. Thus, the company is well set to benefit from this deal.

Continued Divestment

Presently,

revenue growth is not a part of Alcatel's plan as the company is more

focused on streamlining its business. Combes promised the sales of

non-profitable assets worth €1 billion and a €1 billion reduction in

overheads by 2015 as a part of his Shift Plan. The positive effects of

Shift Plan are visible in the company's quarterly report as the

company's operating income and gross margin jumped 167% and 4%,

respectively.The company is also in talks to sell 85% stake in its enterprise unit to China Huaxin in a deal worth $362 million. The sale, which is due to be completed before the end of the second quarter, would be the second disposal administered by Combes. The continued divestment will not only help Alcatel to boost its gross margin and operating income, but is also important to enhance the company's overall financial outlook. As you know, Alcatel is a highly leveraged company with total debt/equity ratio of over 168. Consequently, in some quarters, the company fails to generate enough cash to keep up with the interest expenses. Thus, the divestments and overhead reduction is important as it will help Alcatel to pay off debts and transform it into a company that can be sustainably profitable over the long term.

Why Buy

Despite having a

stellar year, Alcatel has more room to grow than peers like Nokia and

Ericsson. For the reported quarter, Alcatel's operating margin jumped 5%

to 7.8%, however, it's still less than Nokia and Ericsson, which

reported operating margins of 11.2% and 10.3%, respectively. Going

forward, the disposal of Enterprise business will further improve

Alcatel's operating margins. And given that it has the least operating

margin amongst its peers; it is highly likely that it will outperform

them in 2014 as well. Moreover, with a price/sales ratio of 0.51 Alcatel

is cheapest of the lot; therefore I think investors should buy it

before it gets pricey.

I couldn't give the case for ALU better so I cut and pasted this from Seeking Alpha. I have been long ALU for a few years, starting getting in around $1.20 a share. Good luck investing. Tony